And so it begins… again…

I wanted this blog to include a few personal things — not just instructions. I want to document how I’m becoming a millionaire again by following the same steps that got me there in the first place.

Don’t get me wrong — I think it’ll be slower this time. I have three kids now. The outlook in my industry doesn’t look as stable with AI coming into play. But I have faith that with a little planning and making sure things are moving in the right direction, I’ll be okay.

I’ve finally finalized the divorce with my ex. I don’t want to go into major details, but it was a bad one. The good news is that financially, I’m not starting from zero. I’m starting at what I would call “the end of the beginning.” And honestly, that’s good enough for me.

There’s a famous story about two monks that comes to mind:

A senior monk and a junior monk were traveling together. At one point, they came to a river with a strong current. As they prepared to cross, they saw a young woman struggling to get to the other side. She asked if they could help her. The monks glanced at one another — they had taken vows not to touch a woman. Without saying a word, the older monk picked her up, carried her across the river, gently placed her down, and continued on his journey. The younger monk was shocked. An hour passed in silence. Then two. Then three. Finally, he couldn’t hold it in anymore. “As monks, we are not permitted to touch a woman. How could you carry her on your shoulders?” he asked. The older monk looked at him and replied, “Brother, I set her down on the other side of the river. Why are you still carrying her?”

I include this story because to move forward, you have to leave the past in the past. Yes, I made mistakes. I bet you have to. Maybe you blame yourself a little bit or maybe you feel entirely responsible. Either way, moving forward in the right direction is what’s important and I believe eventually it’ll all work out in the end. Making mistakes doesn’t make you a bad person. It makes you human. What matters is that you learn from them.

You cannot rebuild while carrying yesterday on your back. I can’t sit here thinking about the lawyer fees, the opportunity costs, or the money spent just to see my kids. If I did, I’d still be the junior monk — when what I want is to be the senior monk. Set it down. Let it go. Walk the path that’s in front of you the best way you can.

If you want to move forward financially — and in life — you have to set it down, let it go, and keep walking as happy as possible.

And that leads to the title of this blog: “And So It Begins… Again…”

I wanted to show you where I am right now in this journey of starting over. I’ll share some of the personal rules I’m setting for myself as I go through it.

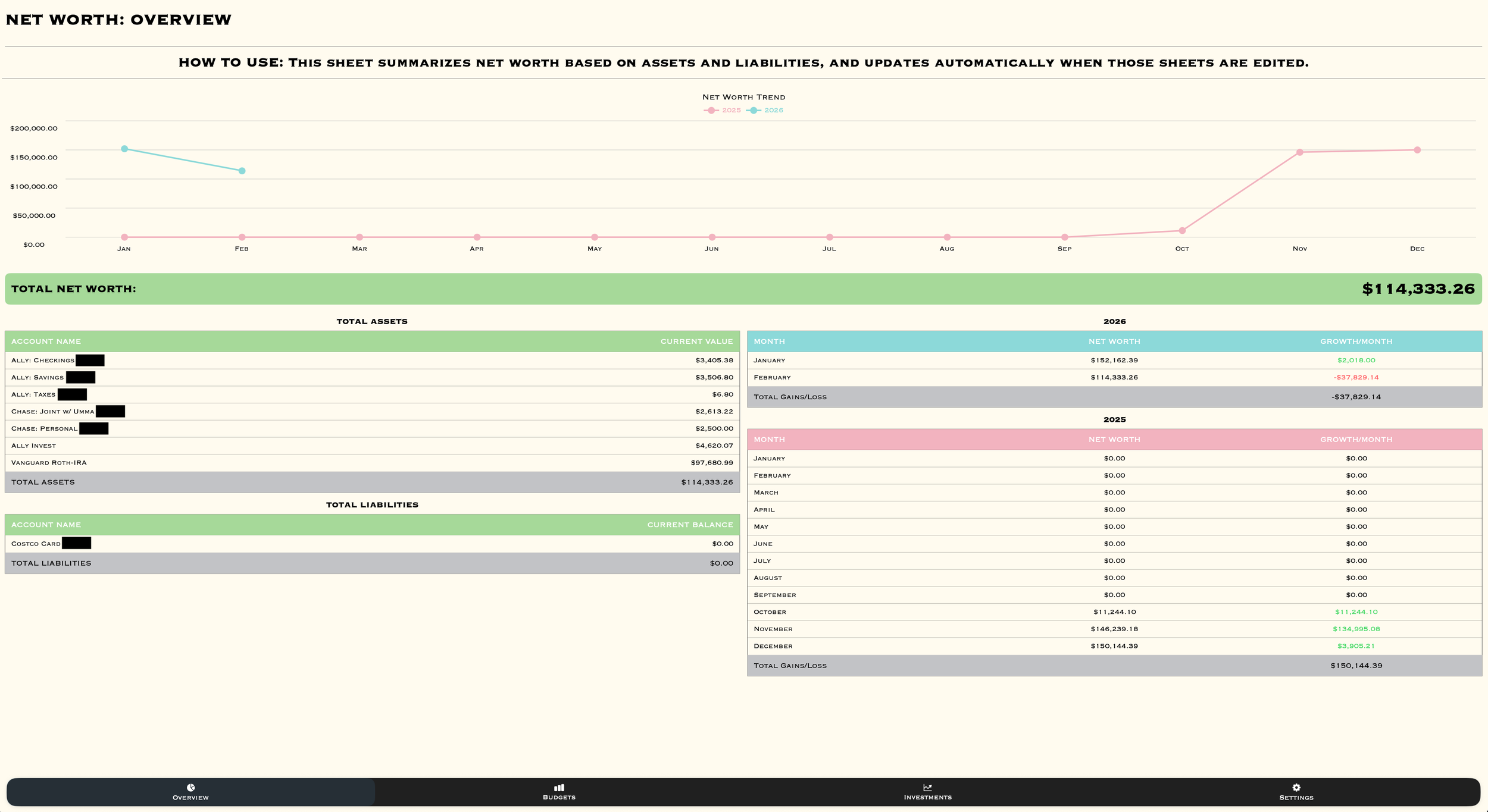

To the right, you’ll see my app and the current state of my finances. There are still a few things that need to be separated from my ex, so not all of the assets that belong to me are reflected in this overview yet. But as of right now, what you see there is what I have.

And from here… we build… and step forward.

Let me give you an overview of how I organize my finances to give you an idea of how you might want to organize yours.

I’m a minimalist at heart and try to carry as few cards as possible. I live by the mottos of simplicity and one of the is “Simple is Best” (I’m also a HUGE FAN of “Occam's razor”)

Right now, my “wallet” is pretty simple: one $100 bill for emergencies, my debit card for ATM access, my Costco credit card (I used to use the Citi Double Cash, but the Costco card gets me into Costco, so between the two I kept that one), and my driver’s license. It’s all MagSafe, so it stays attached to my iPhone.

1) My Bank Accounts

I have two Chase checking accounts. One is used for my family to track payments for family properties. I don’t necessarily count that money as completely mine because it belongs to the family, so I don’t include its value in my net worth, even though I am part of the family. At the moment, I don’t personally benefit from those assets — and that’s not something I’m thinking about anyway.

My personal Chase checking account is different. It holds the $1,500 minimum required to avoid fees, plus an additional $1,000 buffer. This is my “just in case” money — the cash I can access immediately from a Chase ATM 24/7.

Ally is actually my main bank. When I first opened the account, they had amazing interest rates. Right now they’re okay — not great, not terrible — but they don’t have widespread 24-hour ATM access. That’s why I keep Chase around: immediate liquidity.

I’ve only really needed ATM cash for things like the county fair. I’ll pull a few hundred dollars, and once it’s gone, it’s gone. That’s my built-in spending limit for the day. Maybe once a quarter, for a social thing, I’ll pull a couple hundred out for the casino to hang out with friends. YOU’RE allowed to have some fun. Just remember what I said — once a quarter. That means once every three months. And I don’t use casino ATMs. They’ll charge you five bucks just to pull your own money and if it’s between going to the Chase ATM as I go to the casino or not playing… I would rather not play and just get free soda on the casino (I used to do that in college… learned that lesson). This is why I said spend 15 minutes a day balancing your finances, so you know if you have the extra money or not on a daily basis and I do everyday.

You’ll notice I have three Ally accounts: one checking and two savings.

Ally Checking – This is where my paycheck goes. It’s my main spending account because it doesn’t have the spending limits like their savings accounts do.

Ally Savings #1 – High-yield emergency fund (3–6 months of expenses).

Ally Savings #2 – Taxes. DO NOT TOUCH THIS MONEY UNTIL AFTER APRIL. (but also high yield)

The tax savings account exists because when I sell stock or have any taxable events, I immediately move a portion of that money into this account. That way, tax season never becomes a surprise.

The Ally Invest account is my dividend play for everyday spending. I’ll write a separate blog post explaining that strategy, the mindset behind it, and how I divide and use the dividends.

Finally, you’ll see my Roth IRA. I never miss an opportunity to contribute to my Roth. Every year, I max it out as much as possible. That’s non-negotiable for me.

2) Credit Cards

I know some people like to have multiple cards for “credit card churning,” but I just don’t have the patience — or the desire — to carry a big wallet. I prefer simplicity, so I settled on one main card for everything.

That decision came down to the Citi Double Cash or the Costco Citi card. I have a Costco membership, and the Double Cash is a Mastercard — but Costco doesn’t accept Mastercard. So that made the decision for me. I closed the Double Cash and kept the Costco card.

Conclusion

That’s it. That’s the current status of my net worth as of 2/13/2026: $114,333.36.

This is where we begin again.

This is where I start again on the path to achieving FIRE.